Free Expert Medicare Help in Utah | Licensed Agents

Navigating Medicare in Utah can feel overwhelming, but you don’t have to do it alone. This comprehensive guide explains Medicare Advantage, Medigap Supplements, prescription drug coverage (Part D), and important enrollment windows for Utah residents. At Revive Insurance, our licensed local Medicare agents offer free expert assistance, helping you select the Medicare plan that fits your health needs and budget. Serving communities from Salt Lake City and Lehi to St. George and beyond—we simplify Medicare, one conversation at a time.

Understanding Your Medicare Options in Utah

Medicare provides healthcare coverage primarily for people aged 65 and older, or those under 65 with qualifying disabilities. It has several distinct parts:

Part A (Hospital Insurance) – inpatient hospital stays, skilled nursing, hospice care.

Part B (Medical Insurance) – doctor visits, outpatient care, preventive services.

Part C (Medicare Advantage) – alternative bundled coverage provided by private insurance companies.

Part D (Prescription Drug Coverage) – covers medication costs.

Today, more than 465,000 Utah residents rely on Medicare coverage to secure their healthcare needs.

Medicare Advantage Plans in Utah

What are Medicare Advantage (Part C) Plans?

Medicare Advantage plans combine hospital, medical, and often prescription drug coverage into one convenient plan offered by private insurers. They frequently include additional benefits like dental, vision, and hearing coverage.

Utah Medicare Advantage Availability (2025)

In Utah, several reputable carriers provide Medicare Advantage plans, including:

SelectHealth

Humana

UnitedHealthcare

Aetna

Cigna

Availability varies by county, with the Salt Lake City area, Utah County, and St. George offering numerous options, whereas more rural areas typically have fewer available plans.

Pros & Cons of Medicare Advantage in Utah

Pros:

Often low or $0 monthly premiums.

Prescription drug coverage included in most plans.

Extra benefits (dental, vision, hearing, wellness programs).

Predictable out-of-pocket costs with annual maximum limits.

Cons:

Limited provider networks, potentially restricting doctor and hospital choices.

Fewer plan choices in rural counties.

Our licensed insurance agents help you with Medicare enrollment. We assist you with paperwork and explain the steps to enroll in your chosen plan. We also cover topics like medicare enrollment deadlines and the open enrollment period.

Medicare Supplement (Medigap) Plans in Utah

What is Medigap?

Medicare Supplement plans (Medigap) help pay out-of-pocket costs Original Medicare doesn't fully cover, like deductibles, coinsurance, and copayments. These standardized plans (labeled A through N) are provided by private insurers.

Learn more about choosing between Medicare supplements with our comparison on Medicare Plan F vs. Plan G.

Popular Medicare Supplements in Utah

Utah seniors most commonly select:

Plan G – Offers extensive coverage, paying all Medicare-approved costs after the Part B deductible is met.

Plan N – More affordable, covers most costs with small copays for office visits and emergency visits.

Popular Medigap insurers in Utah include:

UnitedHealthcare (AARP)

Mutual of Omaha

Regence BlueCross BlueShield

Aetna

Humana

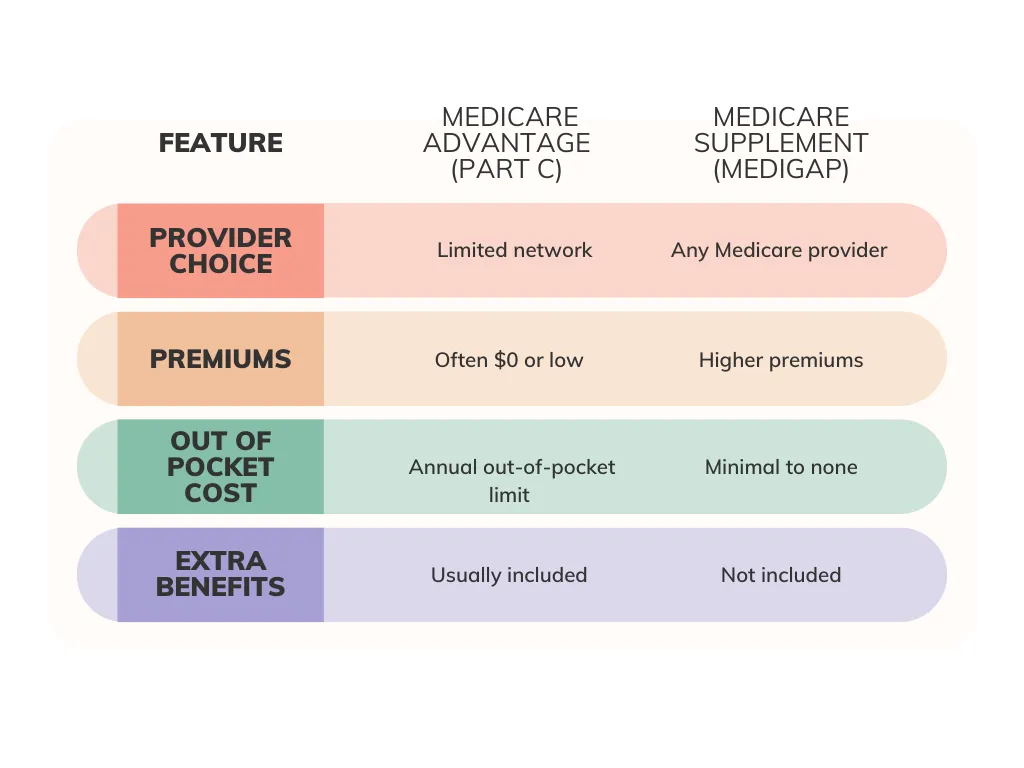

Medicare Advantage vs. Medigap in Utah: Which is Better?

The best choice depends on your healthcare needs, budget, and preferred provider flexibility. Revive Insurance agents can help you weigh these options clearly.

Medicare Part D Prescription Coverage in Utah

Medicare Part D provides coverage for prescription medications. Each Part D plan has its own drug formulary, so it’s critical to verify your medications are covered. In Utah, you have several stand-alone Part D plan options, in addition to those bundled into Medicare Advantage plans.

Medicare Enrollment Windows

Initial Enrollment (Turning 65)

When turning 65, you have a seven-month enrollment window (3 months before, month of, and 3 months after your birthday) to enroll in Medicare coverage.

Annual Enrollment Period (Oct 15 – Dec 7)

During this yearly window, Utahns can make changes to Medicare Advantage or prescription drug coverage for the coming year.

Special Enrollment Situations

Certain situations trigger special enrollment opportunities, such as moving to Utah from another state, losing employer coverage, or qualifying for Medicaid.

Medicare Costs in Utah (2025 Overview)

At Revive Insurance, we specialize in Medicare and health coverage. As one of Utah’s leading Medicare broker agencies, we offer a full suite of services to meet your needs:

What is Medigap?

Unsure which Medicare plan is right? We explain the differences between Original Medicare, Medicare Advantage (Part C), Medicare Supplement plans, and Part D drug coverage. You’ll learn the pros and cons of each and see side-by-side comparisons of costs and benefits. Our Medicare brokers make it easy to compare and choose.

Popular Medicare Supplements in Utah

When you’re ready to sign up, we’re here to help with Medicare enrollment from start to finish. If you’re new to Medicare, we’ll guide you through enrolling in Part A and B. Then we’ll help enroll you in the private plan(s) of your choice (Advantage, Supplement, and/or Part D). Already on Medicare but need to switch plans? We handle those enrollments too. We ensure all paperwork is filed correctly and deadlines (like the Annual Enrollment Period) are met.

Worried about out-of-pocket costs that Original Medicare doesn’t cover? We’ll show you options for Medicare Supplement (Medigap) plans. These plans can pay for deductibles, co-pays, and other expenses so you have more predictable healthcare costs. Our agents explain how Medigap works, who it’s best for, and help you find the best rates.

Medicare Resources for Utah Residents

(Free personalized help from independent agents—no government affiliation).

Bottom line: Working with a Medicare agent means you get an expert advocate. You’ll save time (we do the research for you), avoid costly mistakes (like penalties or inadequate coverage), and gain peace of mind knowing a knowledgeable professional has your back. And remember – you don’t pay us a dime for this service. We’re here to help you get the most out of Medicare at no extra cost.

Our Services

Frequently Asked Questions about Medicare in Utah

Is Medicare different in Utah compared to other states?

Core Medicare coverage (Parts A & B) is federally standardized nationwide. However, Medicare Advantage and prescription drug plan availability, benefits, and premiums vary by Utah county.

How do I choose a Medicare Advantage plan?

Consider network providers, monthly premiums, additional benefits (vision/dental), prescription coverage, and out-of-pocket limits. See here to learn how to select the plan thats right for you.

Which Medigap plan is most popular in Utah?

Plan G is most popular due to extensive coverage. Plan N is gaining popularity for affordability and excellent coverage.

Can I switch from Medicare Advantage back to Original Medicare in Utah?

Yes, during the Annual Enrollment Period (Oct 15–Dec 7) or the Medicare Advantage Open Enrollment Period (Jan 1–Mar 31).

Does Medicare cover dental and vision in Utah?

Original Medicare does not, but many Utah Medicare Advantage plans include dental and vision benefits.

Can I get financial help with Medicare costs in Utah?

Yes, Utah residents can qualify for Medicaid, Medicare Savings Programs, and Extra Help for prescription medications.

Why Utah Residents Choose Revive Insurance for Medicare

Local Utah-based licensed Medicare specialists who understand your needs.

Free, unbiased comparisons of multiple Medicare insurers.

Personalized guidance tailored to your healthcare needs and budget.

No cost or obligation to use our licensed agents’ expert advice.

Our Agents

Ivun Sorensen – Licensed Agent (Lehi, UT)

Ivun has been helping Utah families with insurance for over 20 years. He’s passionate about educating clients and creating financial peace of mind.

Ira Sorensen – Licensed Agent (Salt Lake County, UT)

Detailed, organized, and caring – Ira goes the extra mile to find the right solution for each person he works with. With two decades of experience, he’s seen it all and is excited to assist you.

Allan Boothe – Licensed Agent (Utah County, UT)

Allan thoroughly enjoys working with people and strives to help individuals and families make informed choices that will offer them peace of mind… whether it be health insurance, life insurance, or retirement planning.

Laura Holt – Licensed Broker (Salt Lake County, UT)

Laura began her insurance career in customer relations as she worked to maintain solid relationships with clients. One of her main goals has always been to help each client personally and give great service.

Darla Locher, Licensed Agent

Darla loves sports, outdoors, joking around, but most importantly – helping people. Having been self employed for decades she has discovered that figuring out insurance for her family each year was daunting. Becoming an agent has led her to want to help educate others to make informed decisions in their health coverage needs.

Melanie Cain, Licensed Agent

Melanie loves the beach, the mountains, reading, watching movies and spending time with her family. She genuinely loves meeting, helping and working with people. With a commitment to promoting health and well-being, she is dedicated to helping individuals and families navigate the complexities of healthcare coverage.

Don’t wait to get the Medicare coverage you need. Revive Insurance is here to help you make smart choices about your healthcare. Call 801-901-8448 or click the button below to request your free quote and speak with one of our licensed insurance agents. We will work with you to find the best medicare insurance plan that fits your needs.

Get Your Free Quote Today!

Map

We proudly provide exceptional health insurance and Medicare assistance to clients across Utah,

Website Managed by Superb Marketing ™

"We do not offer every plan available in your area. Currently we represent 13 organizations which offer 405 products in your area. Please contact

Medicare.gov

, 1‑800‑MEDICARE, or your local State Health Insurance Program to get information on all of your options."

Participating sales agencies represent Medicare Advantage [HMO, PPO, PFFS, and PDP] organizations that are contracted with Medicare. Enrollment depends on the plan’s contract renewal.”

NOT AFFILIATED WITH OR ENDORSED BY THE GOVERNMENT OR FEDERAL MEDICARE PROGRAM.

Serving Utah with trusted Medicare plan options, enrollment assistance, and expert support.